PERU'S PAYMENT AND SALES LANDSCAPE

Peru is one of Latin America’s Six Main Markets, which together represent 88% of the region’s population and 93% of its GDP. Among them, Peru is the one with the fastest rate of e-commerce growth, surpassing $ 34 billion in 2024.

Discover why you should expand or strengthen your operations in Peru and how PagSeguro helps you do that successfully.

Dive into Peru's fast-rising e-commerce market

Growth across all segments

Today at a market size of $34 billion, Peru’s e-commerce will grow to surpass $ 63 billion by 2026, driven by growth across all industries, in particular streaming and the gig economy, restaurants, grocery, gaming, and general retail.

Cross-border sales growth

Peru has a considerable share of cross-border sales volume, which represent 23% of all online sales. Due to the small size of the local market, consumers turn to foreign merchants as points of access to greater variety and quality.

Instant methods rising fast

With more than 14 million users, Peru’s Yape is a major examples of a rapid payment tool that is gaining huge traction in the region after the phenomenal success of Pix in Brazil.

A prime time to boost sales

As the country becomes more digitized, including in sales and payments, Peru becomes an ideal scenario for merchants starting or increasing operations in the country. By 2026, e-commerce in the country should surpass $ 63 billion in total volume.

Navigating Peru's fast-changing payment landscape

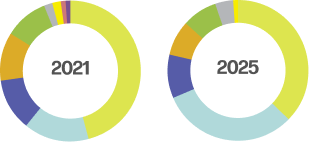

Peru has the highest share of cash usage across Latam (80% of face-to-face retail in 2020), and it’s where credit cards have the lowest share of total e-commerce (37%). However, debit cards and alternative payment methods (mostly cash payments, transfers through PagoEfectivo, Yape, and other e-wallets) have been growing exponentially since the pandemic hit.

A huge change happened at the end of 2021, when P2P platform Yape, which has over 14 million users, first enabled e-commerce payments. This could be a huge digitizer for longtail merchants wanting to accept payment online and a large contributor for the conversion of cash in this rapidly digitizing market.

With PagSeguro, you can navigate this challenging scenario and make the most of Peru’s opportunities.

| Debit cards | 45.5% | 59.5% | |

| Cash vouchers | 19% | 17% | |

| International credit cards | 18.5% | 14.5% | |

| E-wallets | 11% | 6% | |

| Domestic credit cards | 2% | 1.3% | |

| Bank transfers | 1.5% | 0.15% | |

| Buy Now Pay Later | 0% | 0.15% | |

| Others* | 2.5% | 1% |

* Includes prepaid cards, direct carrier billing, cash on delivery, and other miscellaneous payment methods

Unlock Peru's payment landscape with PagSeguro Payment Processing Solution

International funds remittance and the possibility of offering local payment practices, such as in installments.

The reliability you deserve

PagSeguro is PagBank's (NYSE: PAGS) international division, one of the biggest fintech companies in Latam. Besides local payment solutions for foreign companies selling to Latam, it’s also a leading company of online payment methods and solutions for e-commerce, virtual stores, and physical commercial establishments in Brazil with over 7 million merchant customers, and 14M account holders in the second biggest digital bank in Brazil.

Also, it’s part of UOL GROUP, the leading Internet enterprise in Brazil with 108M unique users per month.

EN

EN

ES

ES

ZH

ZH