CHILE'S PAYMENT AND SALES LANDSCAPE

Chile is one of Latin America’s Six Main Markets, which together represent 88% of the region’s population and 93% of its GDP. Chile has extremely high levels of e-commerce penetration: total online sales surpassed $ 40 billion in 2024, representing around $ 900 in annual e-commerce sales per capita.

It’s also the highest banked market in Latin America, with 82% of Chileans owning a bank account and debit card. Discover why you should expand or strengthen your operations in Chile and how PagSeguro helps you do that successfully.

Chile's expanding market is waiting for you

A market open for innovation

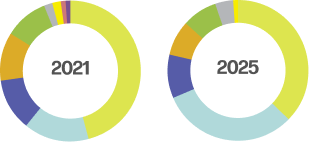

Across the region, instant payments rise and more traditional methods fall. In Chile, cash transactions account for only 3% of

all payments — the lowest share among the Top Six Markets.

Internet access boosting sales

Among Latam's Top Six Markets, Chile stands out as the country with the highest rate of access to the internet: 93%, up from 83% in 2021.

E-commerce as a daily habit

87% of the adult population in Chile made an online purchase in 2023 — only behind Brazil (90%), Latam's #1 market. More and more, e-commerce becomes a daily habit for the country.

Cards still dominate

Chile is the only Latam country where international credit cards represent the highest share of total payments in e-commerce, at 56%. Even then, alternative methods rise and customers demand a wide variety of options.

Navigating Chile's fast-changing payment landscape

Chile is the highest banked country in Latin America: 82% of Chileans own a bank account and a debit card. This, while credit and debit cards have a high penetration of e-commerce (82%) in the country, alternative payment methods still have a relatively lower importance.

With its small population of 19 million people, Chile has an e-commerce market worth $ 40.1 billion, which represents more than $ 900 online spending per capita, the highest in Latam. For comparison, this number is $ 733 in Brazil and $ 384 in Mexico.

In Latin America, even the smallest markets are full of potential and rising fast — and we can help you navigate the local scenario.

| International credit cards | 55.5% | 50% | |

| Debit cards | 16% | 11% | |

| Bank transfers | 13% | 27% | |

| E-wallets | 6.5% | 6.5% | |

| Domestic credit cards | 3% | 1% | |

| Cash vouchers | 2.5% | 2% | |

| Buy Now Pay Later | 0.3% | 0.2% | |

| Others* | 2.5% | 2% |

* Includes prepaid cards, direct carrier billing, cash on delivery, and other miscellaneous payment methods

Unlock Chile's payment landscape with PagSeguro Payment Processing Solution

International funds remittance and the possibility of offering local payment practices.

The reliability you deserve

PagSeguro is PagBank's (NYSE: PAGS) international division, one of the biggest fintech companies in Latam. Besides local payment solutions for foreign companies selling to Latam, it’s also a leading company of online payment methods and solutions for e-commerce, virtual stores, and physical commercial establishments in Brazil with over 7 million merchant customers, and 14M account holders in the second biggest digital bank in Brazil.

Also, it’s part of UOL GROUP, the leading Internet enterprise in Brazil with 108M unique users per month.

EN

EN

ES

ES

ZH

ZH