COLOMBIA'S PAYMENT AND SALES NUMBERS

Colombia is one of Latin America’s Six Main Markets, which together represent 88% of the region’s population and 93% of its GDP. It’s the region's third largest e-commerce market, worth almost $ 55 billion in 2024 and growing around 21% per year to surpass $ 87 billion by 2026.

Colombia's expanding market is waiting for you

The 3rd main market in Latam

Even surpassing $54 billion in sales in 2024 and being the third largest e-commerce market in Latin America, Colombia’s per capita online spending is only around $ 400 — there is still plenty of room for rapid growth.

Major untapped potential

The country’s e-commerce sector has yet to go through a boom in sales volumes to the same level as Brazil and Mexico. This means that there’s a wide window of opportunity for international merchants exploring this rising market in Colombia.

Alternative methods rising

With banking penetration still limited, Colombian

payment solution PSE skyrocketed in the last few years, and today represents 28% of all e-commerce spending.

The online shopping habit

86% of the adult population in Colombia made an online purchase in 2023 — only behind Brazil (90%) and Chile (87%). More and more, e-commerce becomes a daily habit for the country.

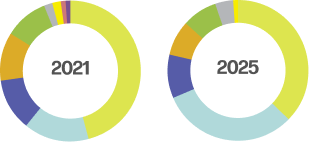

Navigating Colombia's fast-changing payment landscape

The account-to-account payment solution PSE is expanding rapidly in Colombia, already representing a third of online sales in the country and being projected to reach a 40% share in 2026.

Additionally, the Colombian Central Bank is developing its own instant payment system, Bre-B, which was inspired by Pix and is expected to be launched in 2025.

This innovation in payments also boosts online sales growth: Colombia's e-commerce volume is projected to rise with a CAGR of 29% that would more than double the size of the country’s e-retail market, becoming the third-largest online retail market in the region, with a 12% share of the total volume.

With PagSeguro, you can navigate this challenging scenario and make the most of Colombia's opportunities.

| International credit cards | 39% | 38% | |

| Bank transfers | 32% | 40% | |

| Cash vouchers | 8% | 4.5% | |

| Debit cards | 7% | 6.5% | |

| Buy Now Pay Later | 4% | 4% | |

| E-wallets | 4% | 4% | |

| Domestic credit cards | 3% | 2% | |

| Others* | 1.5% | 1% |

* Includes prepaid cards, direct carrier billing, cash on delivery, and other miscellaneous payment methods

Unlock Colombia's payment landscape with PagSeguro Payment Processing Solution

International funds remittance and the possibility of offering local payment practices, such as in installments.

The reliability you deserve

PagSeguro is PagBank's (NYSE: PAGS) international division, one of the biggest fintech companies in Latam. Besides local payment solutions for foreign companies selling to Latam, it’s also a leading company of online payment methods and solutions for e-commerce, virtual stores, and physical commercial establishments in Brazil with over 7 million merchant customers, and 14M account holders in the second biggest digital bank in Brazil.

Also, it’s part of UOL GROUP, the leading Internet enterprise in Brazil with 108M unique users per month.

EN

EN

ES

ES

ZH

ZH